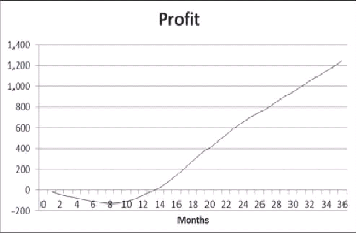

When the PE Fund invests in a start-up, initially the investee company’s losses could increase because of higher costs. Later, many investee companies start making profits. Thus, the shape of the profit curve in a start-up is like the alphabet ‘J’ (or a hockey-stick), as shown in the image above.

The portfolio of a PE Fund is essentially a mix of several such investments. Therefore, the portfolio too follows a similar J-curve. Initially, the expenses of the fund will take it into losses, while the investments would not have started paying off. Gradually, the investments will start paying off, either in the form of dividends or a valuation gain. This will accumulate pace as more and more investments start paying off.