“It sounds extraordinary but it’s a fact that balance sheets can make fascinating reading.” – Mary Archer

You might have heard of the term balance sheet,also known as a “statement of financial position” several times. It is very important for an accountant or a business owner to read and understand the balance sheet. Balance sheet is one of the financial statements of Accountancy and comes under Accountancy 101. We must have a good knowledge of how to read and interpret this widely used Financial statement.

A Balance sheet may be used as a tool by Accountants, Financial Analysts and the owners of the company to track the finances, expenses and owners equity in the company. A good balance sheet displays the financial health of a firm.

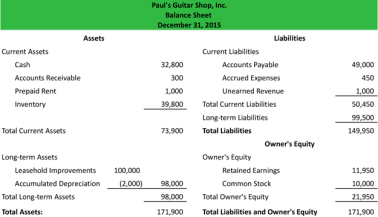

A sample Balance sheet looks like this

A balance sheet has mainly three components-

- Assets

- Liabilities

- Owners Equity

Let us now discuss these three in details

Assets

Assets are nothing but what the company owns. There are two types of assets namely current and non current. Current assets are the assets which can be used up within a year like cash, accounts receivables, inventory etc. The current assets are very important in order to determine liquidity of the finance of the company.

Non current assets are the assets which may not be used up within a year by the company like stocks, bonds issued, buildings, office equipments etc.

Liabilities

Liabilities are just the opposite of assets. They are what the company ‘owes’ to another firm/person. There are things like Accounts payable, employee wages, rentals, bills etc which come under liabilities. Just like assets, they too can be broadly divided into current and non-current liabilities.

Current liabilies are the liabilities which the company has to pay within 12 months or in the current financial year. For example, bills of the supplier, office rentals, taxes, etc. Non current liabilities are just the opposite, they may not be paid within 12 months and the company has more than 1 year to pay them off, for example – loans.

Equity

Owners equity is a form of asset, not to the company though but to the owners of the company. The owners will have some amount of share in the profits of the company. For example, you buy a stock of a company X. Then, you own a part of the company X and your share will come under this section.

Equity is made up of paid-in capital and retained earnings. Paid-in capital is the amount each shareholder initially paid for his or her stock. Retained earnings refers to the amount of money your business didn’t sell to shareholders and instead reinvested into itself.

The basic Accountancy equation states that

Assets = Liabilities + Equities

This means that assets, or the means used to operate the company, are balanced by a company’s financial obligations along with the equity investment brought into the company and its retained earnings. The total assets must equal the liabilities plus the equity of the company. To summarize the balance sheet is so named because the two sides of the balance sheet ALWAYS add up to the same amount. The balance sheet is separated with assets on one side and liabilities and owner’s equity on the other.