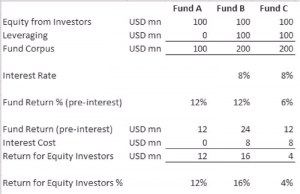

As in any investment, leveraging helps in boosting the returns from the fund. This can be seen from the calculations in Table 1.1.

Table 1.1

Role of Leveraging

Investors in Fund A had the same return as the fund’s pre-interest return, since, there was no leveraging.

Fund B had leveraging of 1 time. The pre-interest return of 12% was higher than the cost of debt of 8%. This higher return of 4% became available to equity investors, boosting their return to 16%. Higher the leveraging, greater would be the extra return to equity investors, so long as the pre-interest return of the fund is higher than cost of debt.

Fund C earned a pre-interest return of 6%, which is lower than the cost of debt of 8%. This pulled down the equity investors’ return to 4%. Higher the leveraging, greater would be the loss to equity investors, if the pre-interest return of the fund is lower than cost of debt.

Given the project risk, VC funds may not like to magnify the risk with leveraging. Leveraging is safer when the fund invests in liquid assets, such as listed equities. Since PE funds focusing on growth capital, invest primarily in illiquid assets viz. equities of companies that are not listed, there is an element of risk if they opt for leveraging. Therefore, leveraging is more often seen with funds that are inclined to invest in PIPE or buyouts or traded securities.

PE funds opting for leveraging prefer to borrow in forms that do not entail high regular debt servicing requirement. Therefore, zero coupon bonds and subordinate debt are preferred to coupon bearing instruments. Similarly, funds like to reserve their pre-payment rights so that they can extinguish the liability depending on when they exit from investee companies