Finite difference methods are a part of the differential equation set which is used to solve various kinds of partial equations. They are an integral part of the Black-Scholes equation and are used as a help for designing and implementing other quantitative models. So, if you are planning to become a financial analyst or already are working in quantitative finance domain, here are top 5 finite difference books which can help take your skills to the next level.

Numerical Solution of Partial Differential Equations: Finite Difference Methods

This book, written by G.D. Smith is one of the best resources to understand the concepts as well as modelling of quantitative models. Covering everything starting from elliptical to parabolic PDE this books is more of a theoretical approach to the basic idea of quantitative analysis. This book can serve as a ‘prequel’ to other books which are focussed more towards implementation and can help both a job aspirant or a student alike.

1. Numerical Method for Partial Differential Equation

Heavy on both theory as well as implementation, Numerical Method for Partial Differential Equation written by G.Evans is the part of Springers Mathematical Series. This book starts with some essential mathematical functions and numerical equations and then dives deep into the concept of the parabolic equation and finite differences. The book explores the whole idea of the finite element method and talks about mathematical tools like variation principles. It is a great catch for anyone looking to learn new modelling techniques and their implementation.

2. Finite Difference Methods in Financial Engineering: A Partial Differential Equation Approach

Written by one of the pioneers in mathematics, Daniel Fluffy, in this book tends to focus on the theoretical concepts of partial differential equations which are followed by a discussion on Finite Difference methods. He has a written a second book which is more focussed towards implementation, which is mentioned in the latter part of this article. This book can be considered as the manual to the application of the finite difference method in C++, questions around which, are mentioned in the second book.

3. Pricing Financial Instruments: The Finite Difference Method

One of the oldest books available on the finite difference method, Pricing Financial Instruments is a complete package starting from explanation to implementation. It covers and explains the concepts like stochastic differential equations, while further dwelling into Feynmann-Kac approach. The writers, Domingo Tavella, Curt Randall, have further tried helping the learners by explaining and showcasing them issues related to jump-diffusion model and performances.

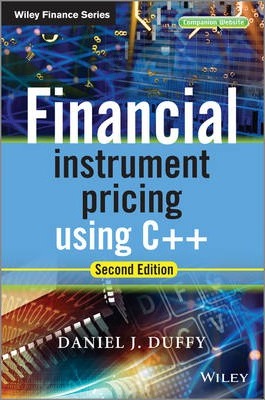

4. Financial Instrument Pricing Using C++

This second part to Daniel Fluffy’s Finite Difference Methods in Financial Engineering focusses on the practical implementation of PDE models using C++ programming language. The author has tried making the learners familiar with the C++ library after which he uses these classes to build essential functions and models.

Finally, he shifts to creating and solving the partial differential model using the object-oriented approach. Towards the end, the book discusses issues one may face implementing the solutions and how to bypass them.

So, these were the top 5 books we would recommend you to read if you are interested in learning about finite difference methods and how to implement them using C++.