Ever Wondered What is the Fund Structure of Private Equity and Venture Capitalists?

Funds operate as trusts, limited liability partnerships (LLPs) or companies. They are typically promoted by a group of professionals (or an established company or group or even Governments), who will part-invest in the fund and manage the fund entirely. Funds promoted by governments, primarily based on corpus that is built by the government are called Sovereign Wealth Funds. This article here, focuses primarily around the fund structure of private equity and venture capitalists.

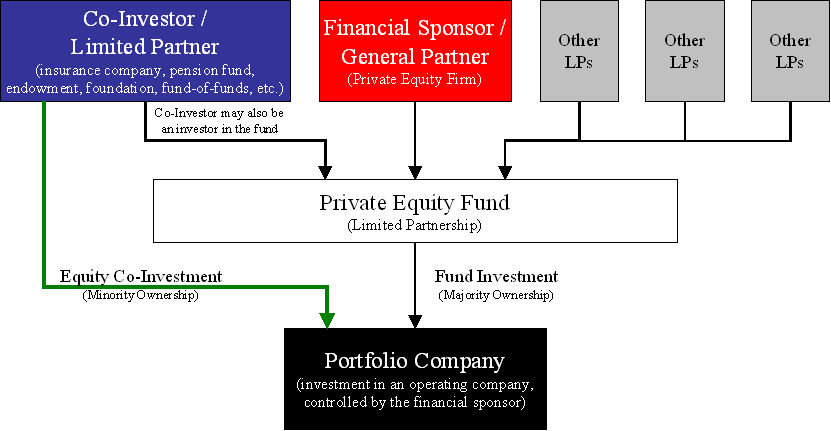

The people who are closely involved in managing the fund call themselves “general partners” (GPs). GPs may also incorporate themselves as an asset management company (AMC). They take the lead in building the corpus of the fund by marketing it to other investors, who are called “limited partners” (LPs). Companies, high net worth individuals, trusts, universities and other endowments are the typical limited partners. A few, who take a large stake of, say, 10-15% or higher, are “anchor investors”. They may even get a seat in a non-executive board of the fund.

Initially, investors only make investment commitments. The subscription agreement normally provides for the investor contributing about 10% of their investment commitment, upfront. The balance will be invested in stages, as and when the fund identifies companies to investment in.

Read more such article from our Archives –

What is Private Equity’s Investment Criteria ?

Measuring the Performance of Investments and PE Fund

Thus, when a fund declares closure at, say, USD500mn, it means it has secured investment commitments of that amount; a small percentage of that would have been received in the fund. This initial subscription is used to meet various scheme running expenses.

Whenever the fund decides to make an investment, it will approach the investors, calling for their contribution. For example, if the fund proposes to invest USD20mn in a company, an investor whose commitment amounts to 15% of the fund size, will receive a call to bring in USD20mn X 15% i.e. USD3mn. Given the inherently illiquid nature of most of the investments that VC and PE funds make, they are not structured as open-end funds. They cannot manage the ongoing sale to and re-purchase of units from investors that is expected of open-end funds.

Suppose the fund proposes to invest fully in a period of 3 to 5 years. Assuming an investment holding period of about 5 years, the fund would be structured as a 10-year closed-end scheme.

Two kinds of fees are charged to the fund:

-

Asset management fee, of say, 2% p.a. on the fund size (i.e. the investment commitment, not the actual amount invested in the fund). Thus, although investors may not have brought in their entire contribution, the fee would be charged on the entire committed amount. The base on which asset management fee is charged can also go up based on valuation gains on the investments made.

-

Profit share (also called ‘carried income’ or ‘carry’) of, say 20% for the AMC / general partners. This may be subject to the investor in the fund getting a hurdle rate of, say, 8%.

In the above structure, 2% will be charged every year on the fund size. This will go towards meeting the scheme running expenses. Further, every time the fund exits an investment, the proceeds are distributed among investors in the fund. At the stage of divestment, 20% of the profits are reserved for the AMC / general partners, subject to the investors earning at least the hurdle rate of 8%.

The hurdle rate is not a commitment, like an interest. If the fund investments do not work out, investors may earn lesser than the hurdle rate, or even lose part of their principal. The AMC / general partners’ will receive their profit share only if the fund return crosses the hurdle rate.

The specifics of how these calculations are made, does vary between funds. Suppose a fund earned a return of 30%, after charging the asset management fees; the hurdle rate is 8% and carry is 20%. Depending on the fine-print, the GP will receive 20% of 30% i.e. 6%; or 20% of (30% – 8%) i.e. 4.4% as carry. If the carry is 6%, then all investors (GP and LP) will receive the balance 24% on their respective investments.

The 6% carry on the entire fund can yield a phenomenal rate of return for GPs who may have contributed only say, 10% to the corpus of the fund. The GPs, LLP, AMC or trust generally starts the process of promoting a new tranche of the fund, when the earlier tranche has invested 50-60% of its corpus. Good performance in the earlier tranches of the fund helps in attracting more investors in later tranches. Large and established PEs have several funds under them, each may have a different investment objective and different sets of investors.

PE funds are leanly staffed. The operating structure of a medium-sized PE managing several funds would have less than 10 partners / directors and some associates to help them with the review of proposals and monitoring of transactions. This becomes possible because they invest large amounts in few investee companies, and hold their investment for a few years – unlike a mutual fund or other investment company that will spread its investments over several companies, and churn its holdings regularly.