Goods and Services Tax (GST) is a new theory in the Indian economy. And irrespective of your profession, it is crucial for you to know about GST. The most reliable way to gather information is through books. So we have made a list of 4 best books on GST India that you can read to learn more about GST.

-

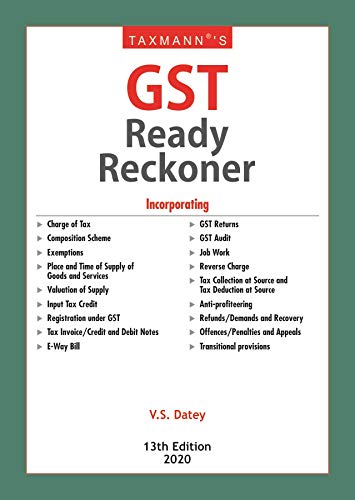

GST Ready Reckoner

No matter if you are a finance student or an expert, this book will be perfect for you if you want thorough knowledge about GST. The major topics covered by the author of the book, V.S. Datey, are:

- Exemptions

- Tax Invoice

- Registration Under GST

- Charge Of Tax

- GST Audit

- E-Way Billing

- Input Off Tax-Credit

And several more.

You might find the book a bit lengthy, but the in-depth knowledge that it provides on GST India can not be compared to any other book. Also, this is the updated version of the original GST book. So it covers the latest concepts of GST as well. The best part about the book is that it covers every possible topic and frames it into such language that you will find it easy to understand.

-

GST For The Layman

The title of this book explains its sole purpose, i.e., to explain the concepts of GST to a layman. That does not mean that you are a layman, but it means that the author of the book, Vishal Thakkar, has put everything in such a simple language that you will not face any difficulty in understanding it. In addition to Goods and Services Tax concepts, the book also elaborates on several complex economic terms. With simple text, you will find diagrams, graphs, and bullet points that will make the understanding of concepts easy. It is the perfect book for finance students and general people who want to learn GST.

-

GST Guide For Students

The title itself specifies that the book is made for students. However, if you are a GST beginner, then also, this book will be a perfect fit for you. Along with concepts of GST, the book covers the information on GST Tax Law. It was a complex topic to cover. However, the author, CA Vivek KR Agrawal, has framed all the text in a simple language so that you will have no problem understanding everything. Also, he has used different illustrations to make your learning effortless.

-

Student’s Guide To Income Tax Including GST

The book throws light on all the aspects of the Indian taxation system, which makes it the perfect book for students. The book might feel a little lengthy, but the concepts are kept clear and engaging using graphs and examples. It will be a perfect fit if you do not even know the basics of accounting or taxation.

Conclusion

Understanding of Goods and Services Tax (GST) has become crucial for everyone now. To comply with the rules, you need to have a thorough knowledge of the subject. With these latest GST books, you can easily understand everything about GST India. So pick one up and get started.